Unlock Your Financial Potential With Problem-free Finance Services You Can Count On

In the world of individual finance, the accessibility of problem-free lending services can be a game-changer for people aiming to unlock their financial potential. As we explore the world of hassle-free car loans and relied on services further, we discover important insights that can empower people to make educated decisions and protect a steady economic future.

Benefits of Hassle-Free Loans

Hassle-free lendings use borrowers a streamlined and efficient means to gain access to economic support without unneeded issues or delays. In contrast, problem-free lendings focus on speed and convenience, offering debtors with quick access to the cash they call for.

Moreover, hassle-free fundings commonly have minimal eligibility requirements, making them easily accessible to a more comprehensive range of people. Typical loan providers often require extensive paperwork, high credit history, or security, which can leave out several potential consumers. Convenient financings, on the other hand, concentrate on cost and adaptability, providing help to people who may not fulfill the rigid requirements of traditional financial organizations.

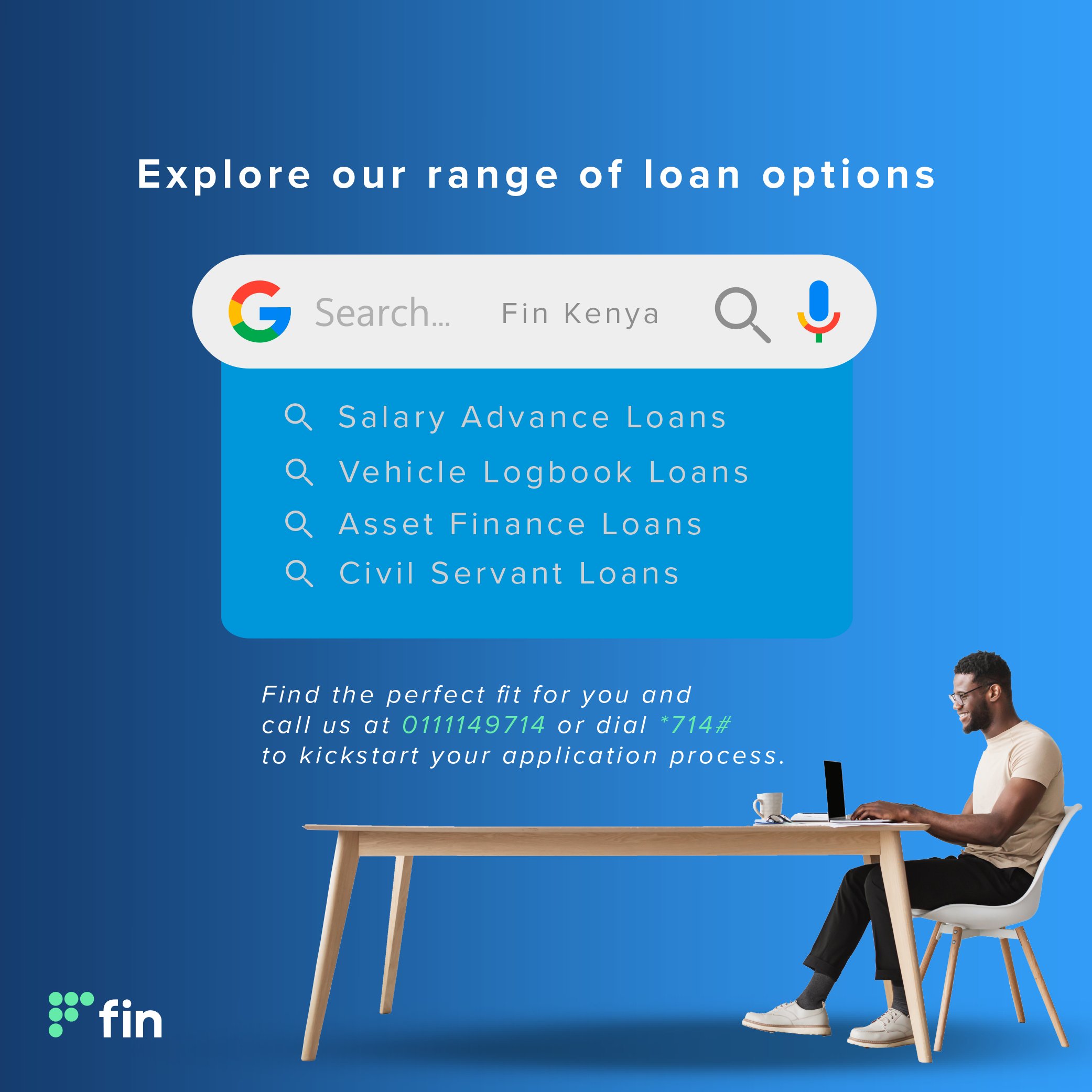

Kinds Of Trustworthy Lending Provider

How to Get a Car Loan

Checking out the key qualification standards is crucial for people looking for to certify for a loan in today's financial landscape. Giving precise and updated monetary info, anonymous such as tax returns and bank statements, is important when applying for a car loan. By understanding and meeting these eligibility standards, individuals can enhance their chances of qualifying for a lending and accessing the economic aid they require.

Handling Lending Repayments Wisely

When borrowers effectively protect a car loan by meeting linked here the key eligibility requirements, sensible management of financing payments ends up being critical for preserving economic stability and creditworthiness. Timely repayment is crucial to stay clear of late costs, fines, and unfavorable influence on credit history. To take care of finance payments sensibly, customers should produce a budget that includes the month-to-month repayment amount. Setting up automated payments can aid make sure that settlements are made on schedule monthly. Additionally, it's recommended to prioritize lending settlements to avoid dropping behind. In cases of monetary problems, communicating with the loan provider proactively can occasionally result in alternate settlement arrangements. Checking credit rating records routinely can likewise aid customers stay notified concerning their credit standing and determine any kind of disparities that may need to be dealt with. By managing funding repayments responsibly, customers can not only accomplish their financial obligations but likewise construct a favorable credit scores background that can profit them in future economic undertakings.

Tips for Picking the Right Finance Choice

Choosing the most appropriate loan option includes detailed research and consideration of private monetary needs and situations. Think about the finance's overall expense, payment terms, and any kind of extra charges connected with the financing.

Additionally, it's important to select a financing that straightens with click here to find out more your financial goals. By adhering to these suggestions, you can confidently choose the right financing option that aids you accomplish your economic purposes.

Final Thought

In final thought, opening your economic possibility with easy car loan services that you can rely on is a liable and clever decision. By comprehending the advantages of these loans, recognizing exactly how to get them, taking care of settlements sensibly, and selecting the ideal car loan alternative, you can achieve your financial objectives with self-confidence and comfort. Trustworthy lending services can supply the support you need to take control of your financial resources and reach your preferred outcomes.

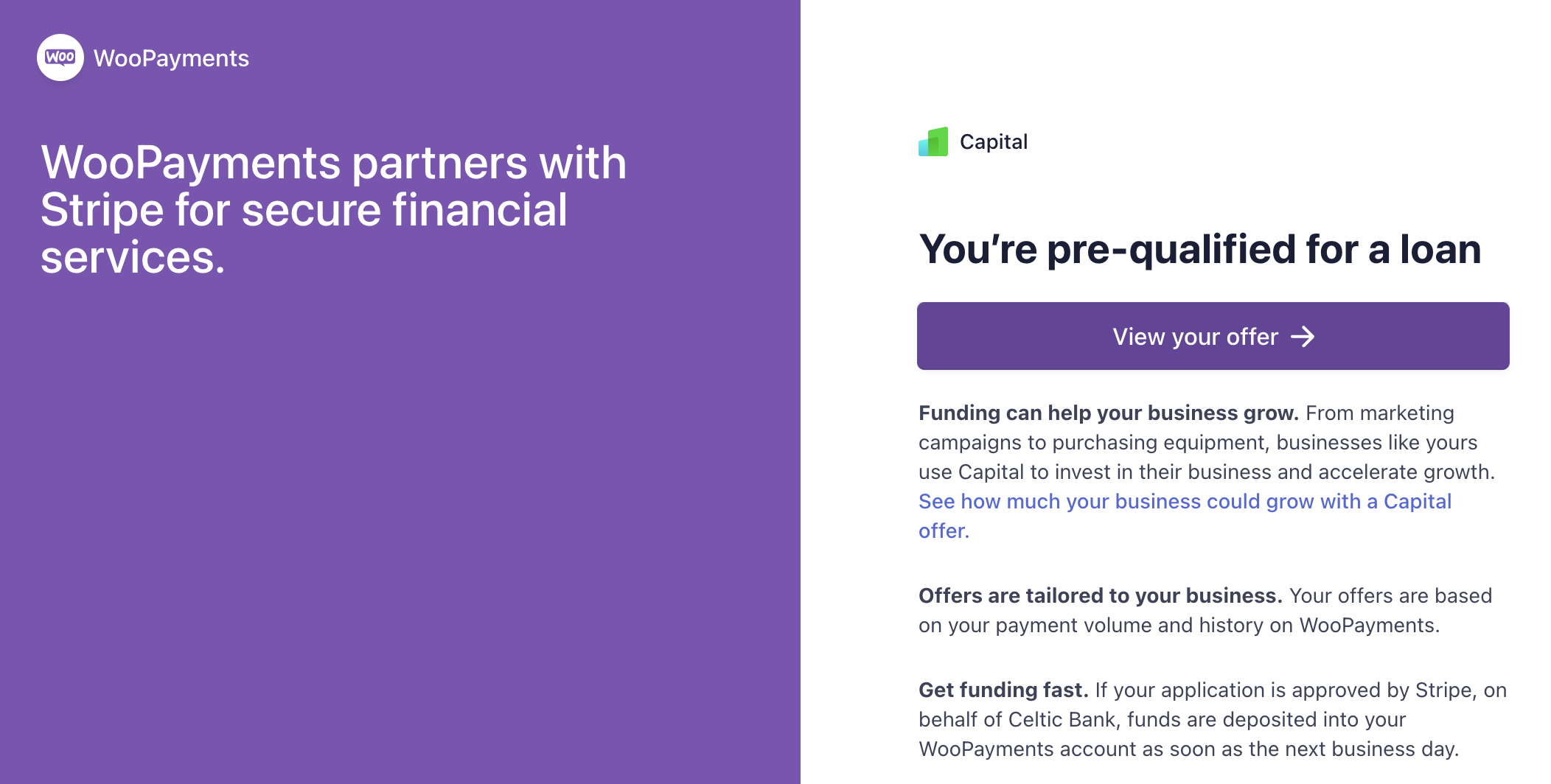

Protected car loans, such as home equity loans or cars and truck title car loans, permit borrowers to utilize security to protect reduced interest rates, making them an ideal selection for people with beneficial possessions.When consumers effectively protect a funding by meeting the crucial qualification standards, prudent monitoring of lending payments ends up being extremely important for preserving monetary security and credit reliability. By managing financing repayments responsibly, borrowers can not only meet their economic commitments yet also build a positive credit report background that can profit them in future economic undertakings.

Take into consideration the lending's total cost, settlement terms, and any kind of added costs linked with the loan.